The global energy landscape is undergoing a significant transformation, and the conflict between Ukraine and Russia is accelerating this shift. After years of declining investment in fossil fuels, capital expenditures in the energy sector are poised to surge, marking a new era in how the world produces and consumes energy. According to industry research, the recent emphasis on energy security, resilience, and diversification is expected to drive substantial changes in energy investments.

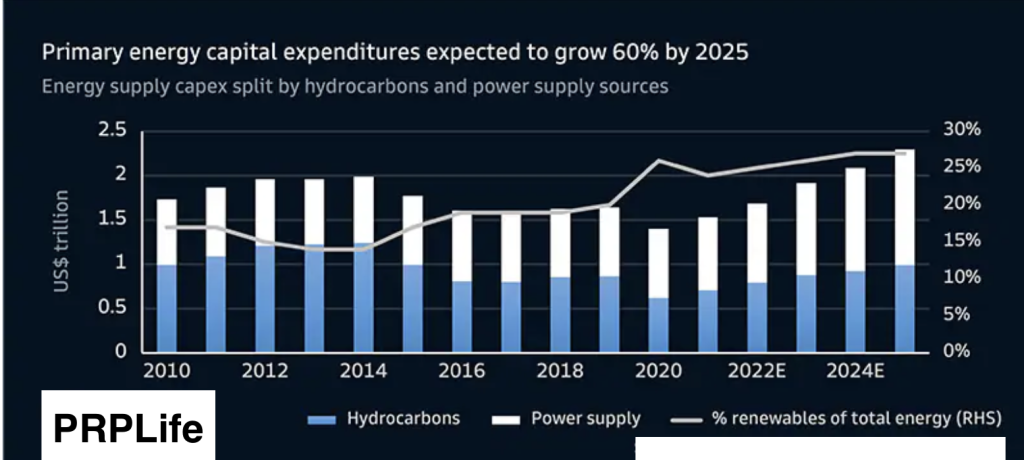

Investment in the production of hydrocarbons, nuclear power, and renewable energy is forecast to increase by 60%, reaching $1.4 trillion over the next three years. This comes after a decade in which energy investments dropped by 35%. While U.S. shale and offshore oil projects are likely to see a resurgence in funding, the global commitment to decarbonization remains strong. This commitment will drive record investments in liquefied natural gas (LNG), renewable energy, bio-energy, and hydrogen, as the world seeks to meet its rising energy demands. By 2024, capital expenditures in the energy sector are expected to rise to approximately $2 trillion annually.

Although clean energy has garnered much attention — with renewable investment surpassing upstream oil and gas spending for the first time in 2020 — the capital flowing into this sector has not fully compensated for the decline in traditional energy investments. Research suggests that while renewables and bio-energy will capture a larger share of total energy supply investments in the coming years, significant investment will still be required in other areas of the energy ecosystem. Natural gas, for example, will continue to play a crucial role as a transition fuel and for energy resilience, and substantial investments in power networks will be necessary throughout the decade. Additionally, long-term investments in clean hydrogen will be essential to achieving a sustainable energy future.

To build a future grounded in sustainable energy, the pace of clean-energy investments must accelerate dramatically. Low-carbon technologies demand significantly more capital per unit of energy than the hydrocarbons they are designed to replace. To reach net-zero carbon emissions by 2050, an estimated $56 trillion in clean tech infrastructure investment — approximately $2 trillion annually — will be required.

What This Means for Investors

For investors, the current energy landscape presents both challenges and opportunities. As global energy dynamics shift, PRPLife is here to help you navigate the evolving investment environment. Whether you’re looking to diversify your portfolio with renewable energy projects or explore opportunities in transitional energy sources like natural gas, PRPLife offers the insights and tools needed to make informed investment decisions in this critical sector.

For more information on how PRPLife can support your energy investment strategy, visit www.PRPLife.com today.