Real Estate

An Attractive

Investment Option

Real Estate

Real Estate

Insights

40k Properties

£4B+ Valuation

Moises Strickland

Head, Real Estate Division

Real estate has consistently proven to be a highly profitable and stable investment model over the years. It is an asset that can generate both passive income and long-term capital appreciation, making it an ideal investment choice for individuals and institutions alike.

Moises Strickland

Head, Real Estate Division

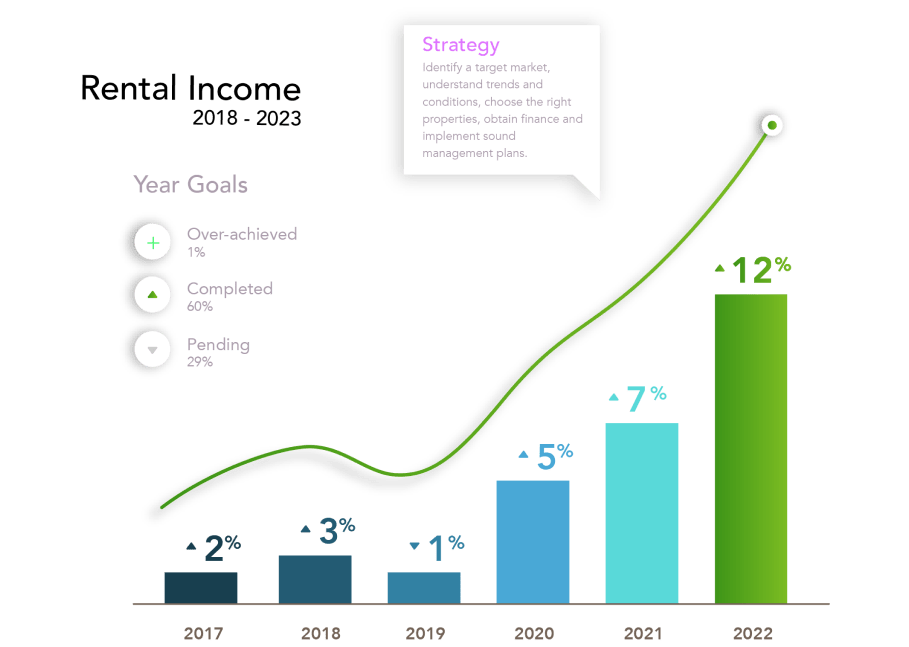

Real estate has always been an attractive investment option for companies looking to diversify their portfolio and generate long-term returns. Our company has been no exception, and we have seen significant success in our real estate investments over the years. Here, we’ll explore the various ways we have invested in real estate, the profits we have seen, and the strategies that have worked for us.

One of the ways we invest in real estate is by purchasing and managing commercial properties. This has been a lucrative avenue for us, as it provides steady rental income and long-term appreciation potential. Our team of experts thoroughly researches each property before making a purchase, ensuring that it meets our criteria for location, size, and potential for growth. In addition to traditional commercial properties like office buildings and retail spaces, we also invest in niche areas like data centres, healthcare facilities, and storage units.

Another way we have invested in real estate is by flipping houses. This involves purchasing a property that needs renovation, fixing it up, and then selling it for a profit. While this strategy can be riskier than other forms of real estate investment, it can also be incredibly lucrative if done correctly. Our team has a keen eye for identifying undervalued properties with potential, and we work closely with experienced contractors to ensure that each renovation is completed efficiently and to a high standard.

We have also invested in real estate through the purchase of raw land. This strategy requires a long-term outlook, as it can take years for the land to appreciate in value.

However, we believe that this is a sound investment for our company, as it provides a tangible asset that can be developed in the future. We carefully research the location and zoning of each property before making a purchase, ensuring that it has the potential for future development.

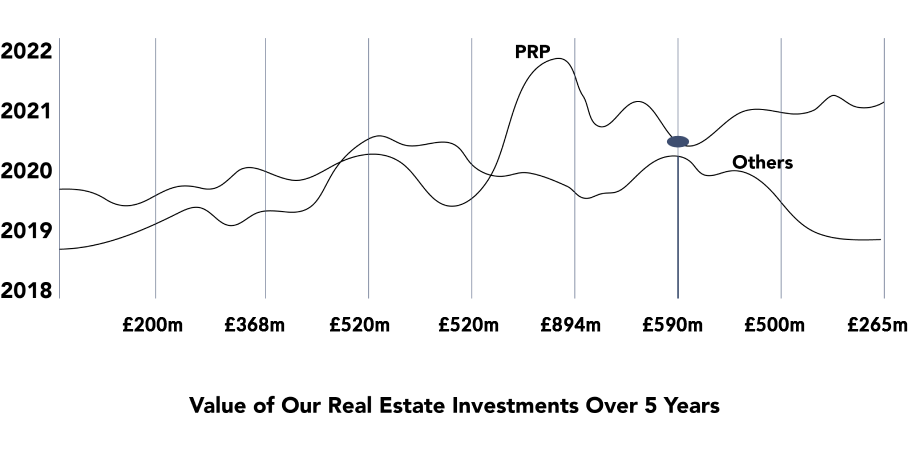

In terms of profits, our real estate investments have been a major contributor to our overall success. In 2020, our commercial real estate portfolio generated a net operating income of £346 million, while our house flipping ventures yielded a profit of £249 million. Additionally, we have seen significant appreciation in the value of our raw land holdings, which are currently valued at over £300 million.

The value of our Real Estate investments have also gone up substantially over the years as shown in the image below and while the market has faced some storm in recent times, our risk management strategies have paid off, resulting in a high plateau state of our investments:

To ensure that we continue to see success in our real estate investments, we have several strategies in place. One of these is a focus on sustainable buildings, which can help to reduce operating costs and attract environmentally conscious tenants. We also prioritise diversification, ensuring that our real estate portfolio is spread across different property types and geographies to minimise risk.

In terms of image ideas, we could include photos of some of our commercial properties, showcasing the different types of properties we invest in. We could also include before-and-after photos of some of our house flipping projects, to demonstrate the potential for profit in this area. Additionally, we could include aerial photos of some of our raw land holdings, to give readers a sense of the scale of our investments.

Overall, our success in real estate investment has been a key driver of our company’s overall success. By carefully researching each property and diversifying our portfolio, we have generated significant profits and created a valuable asset base for our company. We believe that real estate will continue to be a sound investment for us in the years to come, and we are committed to continuing to pursue opportunities in this area.