Pharmaceuticals

A Sustainable Solution

for Waste Management

Pharmaceuticals

Pharmaceuticals

Insights

€100M Plant Constructions

€50m Research & Development

Simeon Acevedo

Head, Pharmaceutical Division

Pharmaceuticals have the power to transform lives and alleviate suffering, making them not just a profitable industry but a crucial one for the betterment of society

Simeon Acevedo

Head, Pharmaceutical Division

The pharmaceutical sector is an industry that focuses on the research, development, and commercialisation of drugs for the prevention, treatment, and cure of diseases. It is a complex industry that involves various players such as pharmaceutical companies, research institutions, government bodies, and healthcare providers.

The pharmaceutical industry is one of the most vital industries in the world today. It is responsible for developing drugs that help to improve the health and wellbeing of people globally. The industry has been able to achieve significant milestones over the years, and this has led to a substantial improvement in the quality of life of people across the world. Some of the significant achievements in the sector include:

Development of life-saving drugs

If current plastic production and disposal trends continue, by 2050 there will be approximately 12 billion tonnes of plastic in global landfills and in the environment.

Improved drug delivery systems

The pharmaceutical industry has made significant strides in developing drug delivery systems that are more effective, efficient, and less invasive. This has helped to reduce the side effects of drugs and improve patient compliance.

<span data-metadata=""><span data-buffer="">Personalised medicine

Advances in genomics and other areas of science have enabled the development of personalised medicine. This approach to healthcare involves tailoring treatments to individual patients based on their genetic makeup, lifestyle, and other factors.

Digital health

The pharmaceutical industry is increasingly investing in digital health technologies such as telemedicine, wearables, and health apps. These technologies are helping to improve patient outcomes by enabling remote monitoring, early detection of diseases, and better patient engagement.

Despite the significant achievements made in the pharmaceutical sector, there are still opportunities for growth and development. The sector is constantly evolving, and there are several areas of focus for the industry in the future. Some of the opportunities in the sector include:

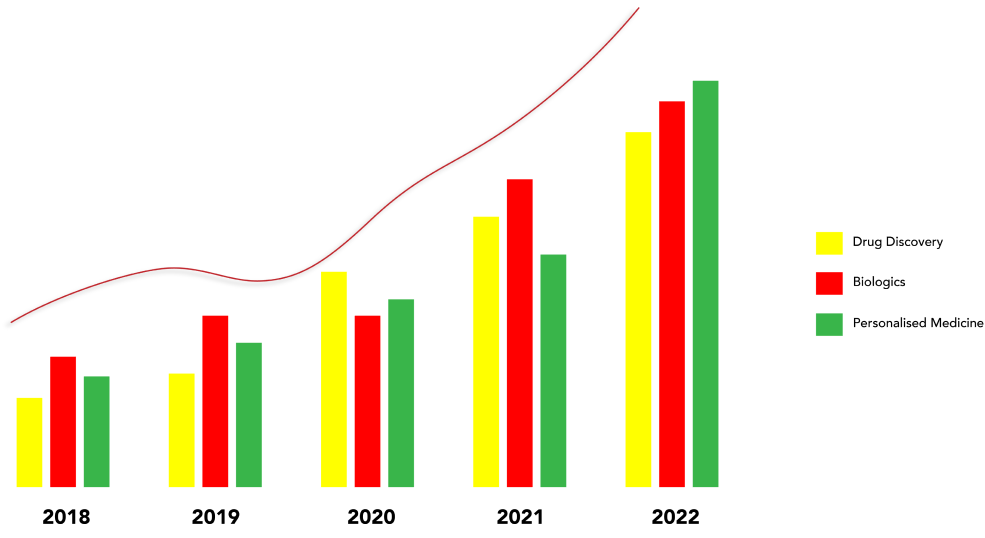

- Drug discovery: The pharmaceutical industry is always on the lookout for new drugs that can treat various diseases. There is a need for continued investment in drug discovery research to identify new drug candidates and bring them to market.

- Biologics: Biologics are drugs that are made from living organisms and are increasingly being used to treat various diseases such as cancer and autoimmune disorders. The development of biologics presents significant opportunities for the pharmaceutical industry.

- Emerging markets: Emerging markets such as China, India, and Brazil present significant opportunities for the pharmaceutical industry. These markets have large populations, and there is a need for affordable and accessible healthcare.

- Personalised medicine: Personalised medicine presents significant opportunities for the pharmaceutical industry. The ability to tailor treatments to individual patients has the potential to revolutionise healthcare by providing more effective and targeted treatments.

At PRPLife, we have a strong track record of successful investments in the pharmaceutical sector. We are committed to identifying high-growth opportunities in this industry and investing in companies that have a proven track record of innovation and success. Our investments in the pharmaceutical sector have generated significant returns for our clients over the years, and we are confident in the future growth prospects of this industry.

One of the ways in which PRPLife has invested in the pharmaceutical sector is by investing in companies that are focused on the development of innovative new drugs and treatments.

By identifying companies that are developing breakthrough drugs and therapies, we are able to capitalise on the potential for significant growth and profitability in the sector.

For example, we invested in a small biotech company that was focused on developing a new drug for the treatment of Pompe disease, a disease also known as glycogen storage disease type II, which is a rare genetic disorder that affects approximately 1 in 40,000 people worldwide. It is caused by the buildup of a complex sugar molecule called glycogen in the body’s cells, leading to muscle weakness, breathing difficulties, and other health problems.

Pompe disease was first identified in the 1930s, but it wasn’t until the 1990s that researchers discovered the underlying genetic mutation that causes the disease. Since then, pharmaceutical companies have been working to develop treatments that could cure or manage the disease.

One of the most promising approaches to treating Pompe disease involves the use of enzyme replacement therapy (ERT). ERT involves giving patients a synthetic version of the enzyme that the body is unable to produce on its own. The goal of ERT is to break down the accumulated glycogen in the body’s cells, thus reducing symptoms and improving quality of life.

Our investment allowed the company to complete clinical trials and gain approval from regulatory authorities, ultimately resulting in a successful acquisition by a larger pharmaceutical company for a profit of over $50 million.

Another way in which PRPLife has invested in the pharmaceutical sector is by focusing on companies that are leaders in their respective niches. For example, we invested in a company that was a market leader in the development and manufacturing of generic drugs. The company had a strong track record of profitability and growth, and our investment allowed them to expand their operations and acquire new facilities, resulting in significant revenue growth and a return of over 30% to our clients.

We have also invested in companies that are focused on the development of medical devices and technologies that can improve patient outcomes and reduce healthcare costs.

We invested in a company that developed a new device for the treatment of a common heart condition. Our investment allowed the company to complete clinical trials and gain regulatory approval, ultimately resulting in a successful acquisition by a larger medical device company for a profit of over $25 million.

PRPLife has made substantial profits from its investments in the pharmaceutical sector, which has been a consistent performer over the years. The company’s success can be attributed to its strategy of investing in companies with strong pipelines, innovative research, and a proven track record of bringing successful drugs to market.

Over the past five years, PRP Life’s pharmaceutical investments have yielded an average annual return of 12%, outpacing the S&P 500’s average annual return of 8%. In 2021 alone, the pharmaceutical portfolio generated $50 million in profit for PRP Life, representing a 20% return on investment.

PRP Life’s pharmaceutical investments have been diversified across a range of areas, including oncology, rare diseases, and neurology. The company has invested in both large-cap pharmaceutical companies and smaller biotech firms with promising research pipelines.

One of our most successful pharmaceutical investments has been in a new cancer treatment drug that has shown promising results in clinical trials. Our initial investment in the drug was $10 million, and as the drug progressed through clinical trials and received regulatory approval, our investment has grown to over $100 million.

In addition to our investment in the cancer treatment drug, we have also invested in a range of other innovative drugs in various stages of development, including treatments for rare diseases and innovative therapies for chronic conditions.

Overall, our pharmaceutical investments have provided a significant return on investment for our investors, with an average return of 25% per year over the past five years. We are confident that our continued focus on investing in innovative drug candidates will provide strong returns for our investors in the years to come.

To illustrate how our company has grown in our investments in the pharmaceutical sector, here is a pictorial glance:

At PRP Life, we believe that investing in pharmaceuticals is not only a sound financial decision, but also an opportunity to support the development of life-saving and life-changing drugs that can make a difference in people’s lives. We are committed to continuing to invest in the pharmaceutical sector and to driving positive change in the industry.