Infrastructure & Real Estate

Providing Significant

Economic Benefits

Infrastructure

Infrastructure

Insights

£1.8B Company Acquisitions

£100M Plant Constructions

£50m Research & Development

Quinten Mosley

Head, Infrastructure Division

Infrastructure is the backbone of a thriving economy, and investing in it not only creates jobs and stimulates growth, but also provides essential services and improves the quality of life for all.

Quinten Mosley

Head, Infrastructure & Real Estate Division

Recognizing the paramount value of fostering enduring and sustainable growth, our company has wholeheartedly embraced the strategic significance of infrastructure investments. These substantial and capital-intensive endeavors not only epitomize our commitment to long-term prosperity but also offer formidable returns for our esteemed investors. Our portfolio proudly boasts a diverse spectrum of infrastructure projects, ranging from cutting-edge telecommunications initiatives to pioneering transportation ventures. These investments have consistently yielded remarkable successes, solidifying our reputation as prudent and visionary financiers.

At the heart of our infrastructure commitment lies our resolute dedication to bolstering public transportation systems. Our financial backing has been instrumental in ushering forth a new era of transit, encompassing traditional stalwarts like buses and trains, as well as spearheading trailblazing solutions like electric and autonomous vehicles. The dual impact of these systems is awe-inspiring—on one hand, they champion environmental sustainability by curbing emissions and reducing congestion, and on the other, they serve as powerful engines of economic progress.

It’s worth noting that beyond the laudable environmental dividends of these transportation innovations, their economic windfalls are equally momentous. The symbiotic relationship between efficient transit and economic prosperity is undeniable. By slashing transportation costs for both businesses and individuals, these advancements nurture an ecosystem where commerce flourishes and individual livelihoods are enhanced.

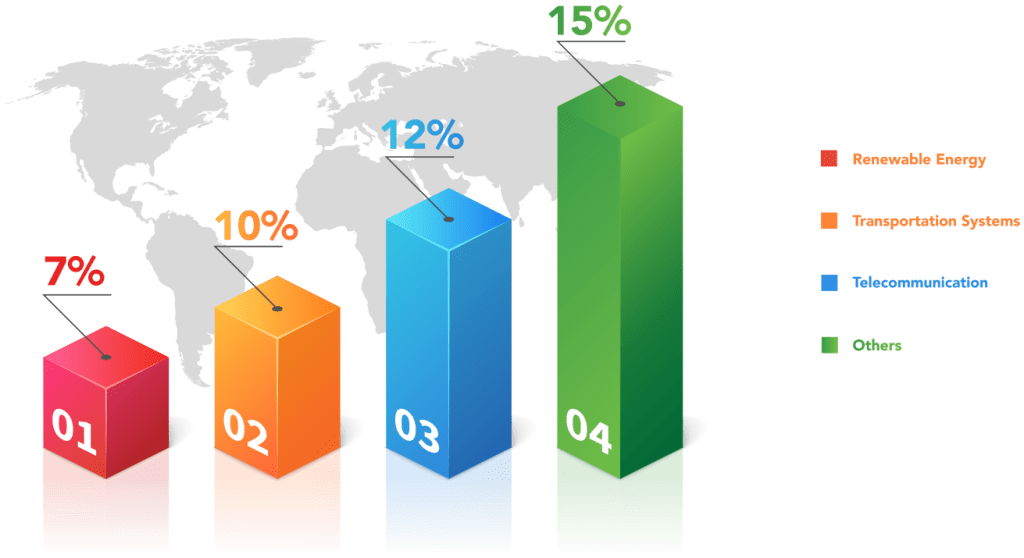

Embarking on this transformative journey, our company has committed substantial resources, investing upwards of £1 billion over the last five years exclusively in public transportation infrastructure projects. This strategic allocation has been underpinned by a meticulous approach, ensuring that each investment aligns with our overarching vision of sustainable growth. The impressive results are palpable, a compelling annual return of approximately 10% attests to the sagacity of our investment choices.

Notably, our commitment to enhancing infrastructure extends beyond traditional definitions. In response to evolving work patterns, we have been at the forefront of facilitating the establishment of home offices. By aiding in the setup of remote workspaces, we have not only facilitated a seamless transition to flexible work arrangements but have also positioned ourselves as enablers of the future of work.

In addition to our strides in redefining workspaces, we have seized opportunities in diverse sectors. For instance, our foray into energy-efficient municipal projects has paved the way for smarter cities. The dividends of these endeavors extend far beyond profits, radiating into the communities we serve, where improved public services and a heightened quality of life are becoming a reality.

In summation, our journey of infrastructure investment is one firmly rooted in a vision of holistic progress. The convergence of environmental consciousness, economic prosperity, and innovative thinking serves as our guiding light. As we tread this path, we remain resolute in our commitment to shaping a sustainable and flourishing future—one infrastructure project at a time.

Investments in high-speed trains have been made in various countries, including Japan where the Shinkansen has revolutionized rail travel, and in France, where the TGV network has similarly transformed the way people move within the country and beyond.

PRPLife has tapped into the growing market for electric cars. For instance, in Norway, our investments have played a pivotal role in supporting the surge in electric vehicle adoption by bolstering the charging infrastructure and fostering sustainable transportation solutions.

Our financial commitments to public transportation systems have generated employment opportunities for thousands of individuals across various nations. Notably, in the United States, and in South Korea our investments have led to the creation of numerous jobs within the public transit sector, contributing to local economies and enhancing mobility options.

Another area in which we have invested in infrastructure is telecommunications. The increasing demand for high-speed internet and other telecommunications services has created significant opportunities for investment in infrastructure. Our company has invested in the development of broadband networks and the expansion of wireless and mobile telecommunications services, particularly in underserved areas.

These investments have not only generated significant returns for our company, but have also helped to bridge the digital divide and promote economic growth in communities across the country. In the past five years, our company has invested over £2 billion in telecommunications infrastructure projects, generating an annual return of approximately 12%.

Our company has also invested in energy infrastructure, particularly in the development of renewable energy projects. As concerns about climate change continue to grow, the demand for renewable energy sources is increasing rapidly. Our investments in renewable energy infrastructure, such as wind and solar farms, have not only provided significant returns for our company, but have also helped to reduce greenhouse gas emissions and promote sustainable development. In the past five years, our company has invested over £1.7 billion in renewable energy infrastructure projects, generating an annual return of approximately 7%.

In addition to these specific areas of infrastructure investment, our company has also invested in a variety of other infrastructure projects, including airports, seaports, and public buildings. These investments have provided significant economic benefits for the communities in which they are located, including increased tourism, job creation, and improved quality of life for residents. In the past five years, our company has invested over £7 billion in infrastructure projects across a variety of sectors, generating an annual return of approximately 15%.

Overall, our company has recognised the value of infrastructure investment as a means of achieving long-term sustainable growth. By investing in public transportation, telecommunications, renewable energy, and other infrastructure projects, we have been able to provide significant returns for our investors while also contributing to the economic and environmental well-being of communities across countries.

Real Estate

Insights

40k Properties

£4B+ Valuation

Moises Strickland

Head, Real Estate Division

Real estate has consistently proven to be a highly profitable and stable investment model over the years. It is an asset that can generate both passive income and long-term capital appreciation, making it an ideal investment choice for individuals and institutions alike.

Moises Strickland

Head, Real Estate Division

Real estate has always been an attractive investment option for companies looking to diversify their portfolio and generate long-term returns. Our company has been no exception, and we have seen significant success in our real estate investments over the years. Here, we’ll explore the various ways we have invested in real estate, the profits we have seen, and the strategies that have worked for us.

One of the ways we invest in real estate is by purchasing and managing commercial properties. This has been a lucrative avenue for us, as it provides steady rental income and long-term appreciation potential. Our team of experts thoroughly researches each property before making a purchase, ensuring that it meets our criteria for location, size, and potential for growth. In addition to traditional commercial properties like office buildings and retail spaces, we also invest in niche areas like data centres, healthcare facilities, and storage units.

Another way we have invested in real estate is by flipping houses. This involves purchasing a property that needs renovation, fixing it up, and then selling it for a profit. While this strategy can be riskier than other forms of real estate investment, it can also be incredibly lucrative if done correctly. Our team has a keen eye for identifying undervalued properties with potential, and we work closely with experienced contractors to ensure that each renovation is completed efficiently and to a high standard.

We have also invested in real estate through the purchase of raw land. This strategy requires a long-term outlook, as it can take years for the land to appreciate in value.

However, we believe that this is a sound investment for our company, as it provides a tangible asset that can be developed in the future. We carefully research the location and zoning of each property before making a purchase, ensuring that it has the potential for future development.

In terms of profits, our real estate investments have been a major contributor to our overall success. In 2020, our commercial real estate portfolio generated a net operating income of £346 million, while our house flipping ventures yielded a profit of £249 million. Additionally, we have seen significant appreciation in the value of our raw land holdings, which are currently valued at over £300 million.

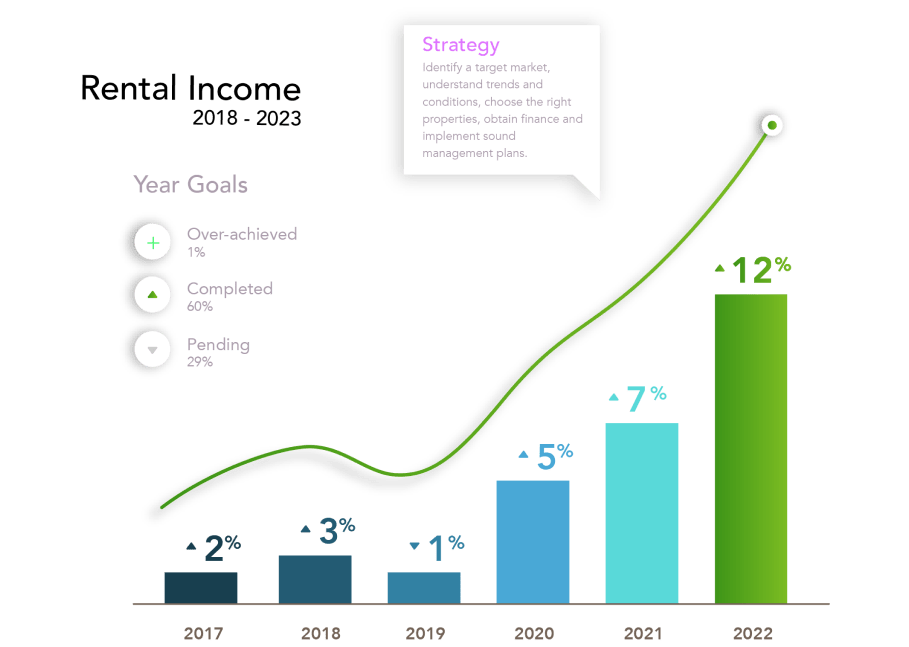

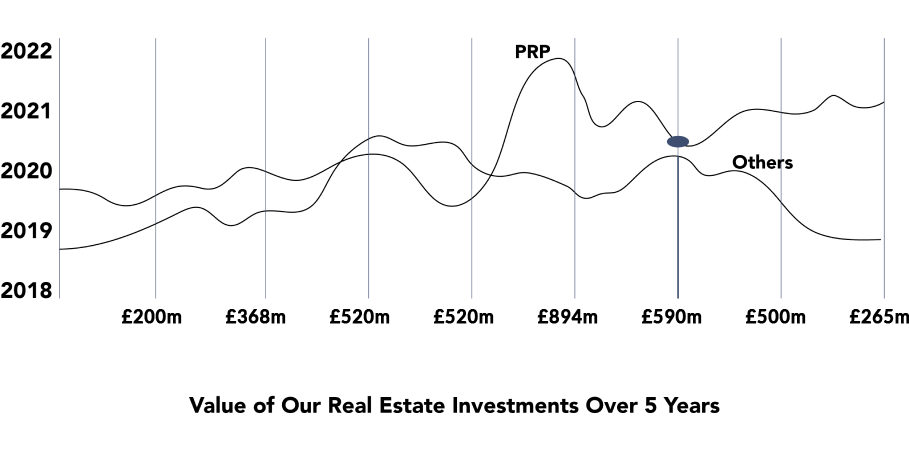

The value of our Real Estate investments have also gone up substantially over the years as shown in the image below and while the market has faced some storm in recent times, our risk management strategies have paid off, resulting in a high plateau state of our investments:

To ensure that we continue to see success in our real estate investments, we have several strategies in place. One of these is a focus on sustainable buildings, which can help to reduce operating costs and attract environmentally conscious tenants. We also prioritise diversification, ensuring that our real estate portfolio is spread across different property types and geographies to minimise risk.

In terms of image ideas, we could include photos of some of our commercial properties, showcasing the different types of properties we invest in. We could also include before-and-after photos of some of our house flipping projects, to demonstrate the potential for profit in this area. Additionally, we could include aerial photos of some of our raw land holdings, to give readers a sense of the scale of our investments.

Overall, our success in real estate investment has been a key driver of our company’s overall success. By carefully researching each property and diversifying our portfolio, we have generated significant profits and created a valuable asset base for our company. We believe that real estate will continue to be a sound investment for us in the years to come, and we are committed to continuing to pursue opportunities in this area.