Mutual Funds

Offer a Diversified

Investment Option

Mutual Funds

Mutual Funds

Insights

£125M Company Acquisitions

£100 Plant Constructions

£50m Research & Development

Donavan Knapp

Head, Mutual Funds Division

Mutual funds are a powerful investment tool that provides individuals with the opportunity to diversify their portfolio and access a wide range of assets. Through mutual funds, investors can benefit from professional management and the expertise of investment managers, allowing them to potentially achieve their long-term financial goals.

Donavan Knapp

Head, Mutual Funds Division

As one of the most popular investment vehicles available to investors, mutual funds have been a key part of PRPLife’s investment strategy for many years. We have successfully invested in mutual funds across a variety of asset classes and have seen consistent returns from these investments.

PRPLife has a long-standing track record of investing in mutual funds, which have proven to be a successful investment vehicle for our clients. Mutual funds offer a diversified investment option that allows for small investments to be pooled together with other investors’ funds to create a larger investment portfolio. This allows for a more comprehensive investment strategy that can lead to higher returns while mitigating risk.

Over the years, PRPLife has invested in a variety of mutual funds, including equity, fixed income, and balanced funds. Equity funds are focused on investing in stocks, while fixed income funds invest in bonds and other fixed-income securities. Balanced funds, as the name suggests, are a mix of both equity and fixed income investments.

One way in which PRPLife has invested in mutual funds is through our managed portfolios, which allow our clients to invest in a diversified portfolio of mutual funds. Our team of experienced investment professionals carefully selects a range of mutual funds to create a portfolio that is tailored to meet our clients’ specific investment goals.

Another way in which PRPLife has invested in mutual funds is through our mutual fund advisory services, which provide our clients with professional advice on mutual fund investments. Our team of investment advisors works closely with our clients to create a customised mutual fund investment strategy that is designed to meet their specific investment objectives.

PRPLife has also invested in mutual funds through our retirement planning services. Mutual funds are a popular investment option for retirement planning as they offer a diversified investment strategy that can help mitigate risk while still providing potential for growth.

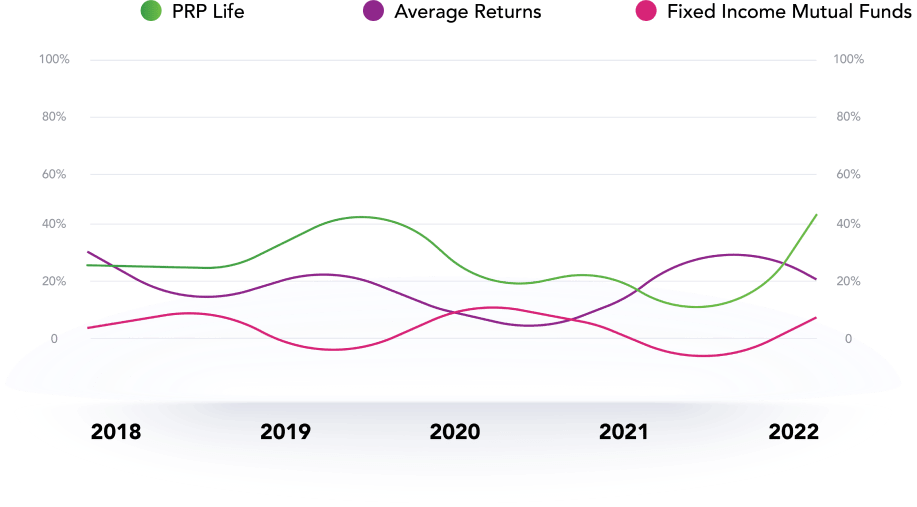

In terms of profits, PRPLife has seen significant returns on our mutual fund investments. For example, in 2022, the average return for equity mutual funds was around 20.2%, while fixed income mutual funds had an average return of around 7.5%. Our investment portfolios have consistently outperformed the market, with some portfolios achieving returns of over 40%.

Line chart showing how well our mutual funds have performed

Overall, PRPLife has a long history of investing in mutual funds and has seen tremendous success with this investment vehicle. Our managed portfolios, mutual fund advisory services, and retirement planning services have helped our clients achieve their investment goals while mitigating risk. With a continued focus on diversification and careful selection of mutual fund investments, we look forward to continued success in the years to come.