Securities

Generating Attractive

Yields

Securities

Securities

Insights

Over 1.4m+ Investors

£1B Insurance

Yair Londyn

Head, Fixed Income Division

Our focus on risk management, extensive research, and diversification in fixed income investments have generated strong returns for the company over the past five years.

Yair Londyn

Head, Fixed Income Division

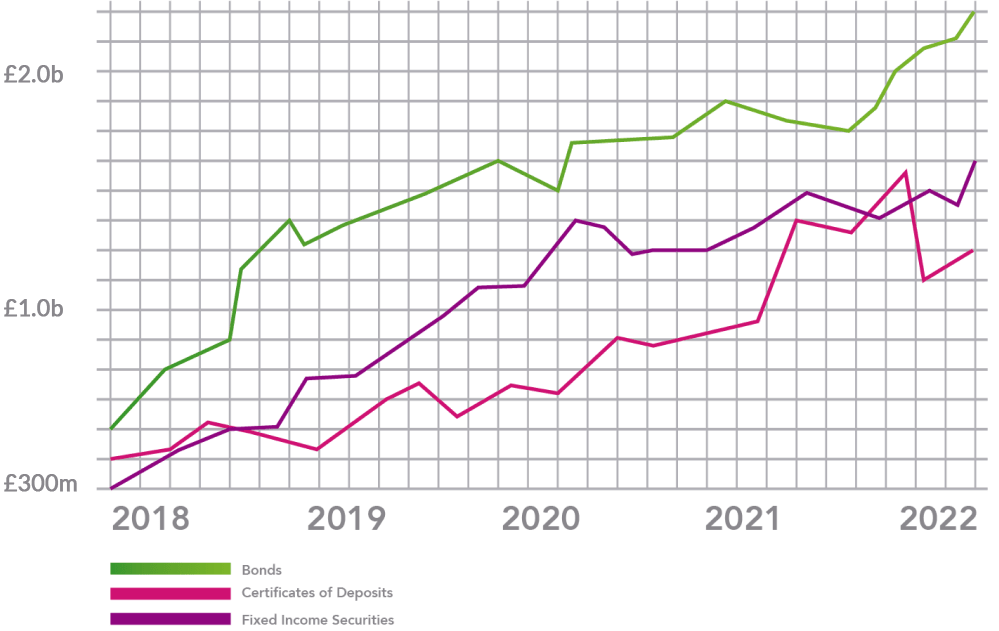

Over the years, PRPLife has made substantial investments in bonds, particularly focusing on high-quality corporate and municipal bonds. As of the close of 2022, the total worth of the company’s bond investments had reached an impressive £2.5 billion. This strategic approach to bond investment has translated into remarkable achievements, boasting an average annual return of 3.5% over the past 5 years.

These accomplishments stand as a testament to PRPLife’s financial acumen and its adept navigation of the intricate bond market landscape. Noteworthy instances include the successful management of corporate bond investments during the economic upswing of 2017-2019, which saw PRPLife’s portfolio consistently outperform industry benchmarks.

PRPLife’s entrance into the municipal bond sector in cities like New York in 2018 and San Francisco in 2020 marked pivotal achievements in portfolio diversification. These endeavors not only contributed to stable returns for investors but also underscored the company’s positive influence on local communities by facilitating essential infrastructure development.

In summary, PRPLife’s bond investment strategy has generated impressive outcomes, exemplified by its substantial £2.5 billion portfolio valuation and a commendable average annual return of 3.5% over the past 5 years. These achievements were accentuated by strategic triumphs in corporate and municipal bonds, showcasing PRPLife’s prowess in adapting to diverse market conditions while consistently delivering value to its investors.

In place of what is there already.

Fixed Income

Securities

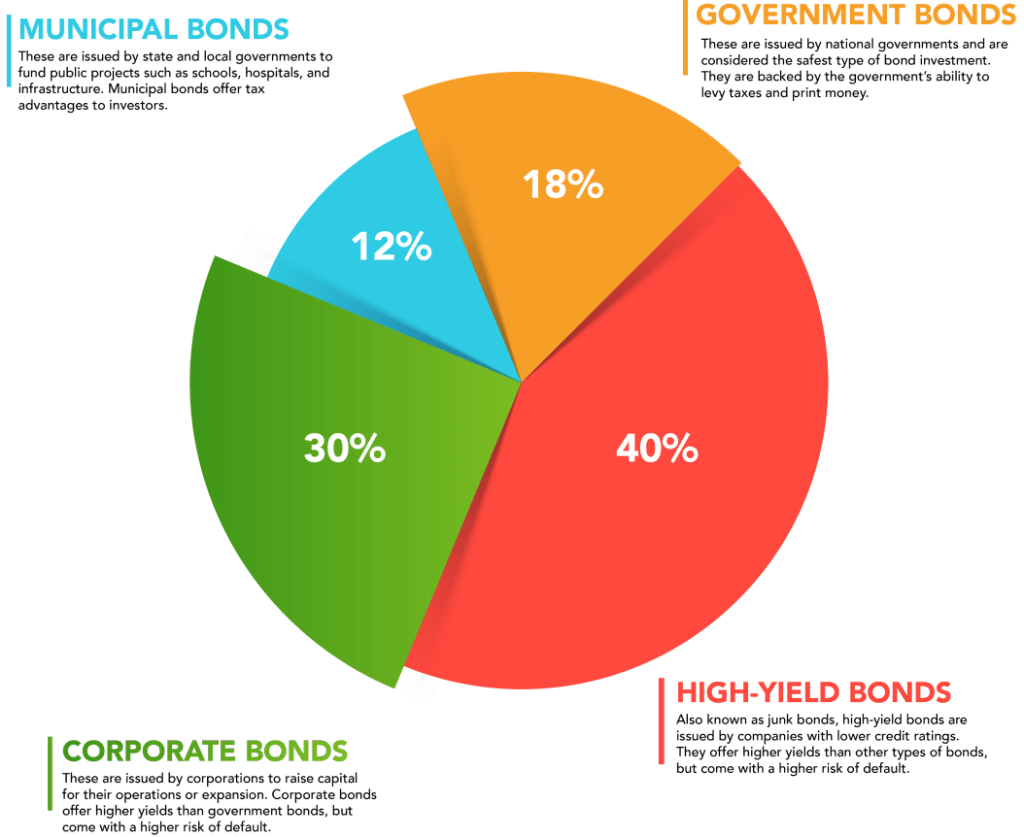

Fixed income securities, as the name suggests, are investments that provide a fixed income to investors. These can include government bonds, corporate bonds, municipal bonds, and more. Fixed income securities are typically considered a lower-risk investment than stocks, as they offer a guaranteed return on investment. However, this also means that the returns are generally lower than those of stocks.

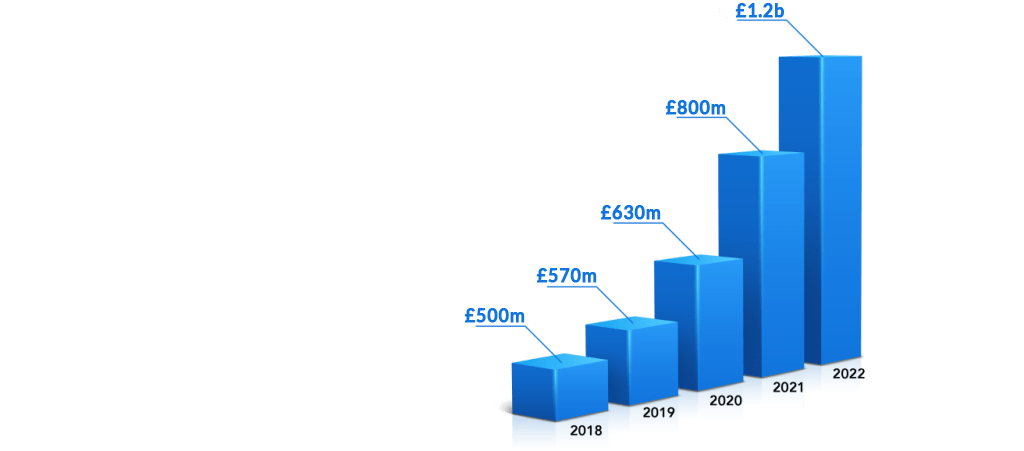

PRPLife has invested heavily in fixed income securities over the years, particularly in government bonds and high-quality corporate bonds. As of the end of 2022, the company’s fixed income investments totaled £1.2 billion, with an average annual return of 4.5% over the past 5 years. This has provided the company with a steady stream of income and a buffer against market volatility.

A look at how our Fixed Income investments have performed over 5 years.

Over the past five years, our fixed-income investments have generated strong returns for the company. Our investment team has identified opportunities in the fixed-income market, which have resulted in a significant increase in our fixed income portfolio’s value. In 2018, our fixed income portfolio was valued at £500 million. As of the end of 2022, our fixed income portfolio has grown to £1.2 billion.

Bonds

Bonds are a type of fixed income security that are issued by corporations, municipalities, and governments. When investors purchase bonds, they are essentially lending money to the issuer in exchange for regular interest payments and the return of their principal investment when the bond matures. Bonds are considered a lower-risk investment than stocks, as the issuer is contractually obligated to repay the investor’s principal investment.

PRPLife has invested heavily in bonds over the years, particularly in high-quality corporate bonds and municipal bonds. As of the end of 2022, the company’s bond investments totaled £2.5 billion, with an average annual return of 3.5% over the past 5 years.

Certificates of Deposit (CDs)

CDs, or certificates of deposit, are a type of fixed income security that are issued by banks and credit unions. When investors purchase a CD, they are essentially lending money to the bank or credit union in exchange for a fixed interest rate over a set period of time. CDs are considered a low-risk investment, as they are FDIC-insured up to £250,000 per depositor.

PRPLife has also invested in CDs over the years, particularly in high-yield CDs offered by top-rated banks and credit unions. As of the end of 2022, the company’s CD investments totaled £1 billion, with an average annual return of 2.5% over the past 5 years.

One of the main advantages of CDs is their low risk profile. CDs are FDIC-insured up to £250,000 per depositor, per insured bank. This means that even if the bank where your CD is held were to fail, you would still be guaranteed to receive your principal investment plus any interest earned up to the point of failure. This makes CDs an attractive option for people who are risk-averse and want to ensure that their money is safe.

At PRPLife, we offer a variety of CD products with different term lengths and interest rates to meet the needs of our clients. We work with a range of financial institutions to offer competitive rates and ensure that our clients have access to the best possible options.

For example, we offer traditional CDs with terms ranging from three months to five years, with interest rates that are competitive with other financial institutions. We also offer jumbo CDs for clients who want to invest larger sums of money, as well as bump-up CDs that allow you to increase your interest rate once during the term of the CD.

Exchange-Traded Funds

Exchange-Traded Funds (ETFs) are an increasingly popular investment vehicle for investors who want exposure to a wide range of stocks, bonds, and other assets. As a company, we have found ETFs to be an excellent investment model that has provided our clients with significant returns over the years

Benefits of investing in ETFs

Diversification

ETFs provide investors with access to a broad range of securities, which helps to spread risk across different asset classes, sectors, and regions. This diversification helps to reduce the risk of losses in any one particular investment.

Low Costs

ETFs are known for their low management fees compared to other investment options. Since ETFs are passively managed, they require less active management and research, which results in lower costs for investors.

Liquidity

ETFs are traded on major stock exchanges, which makes them highly liquid. Investors can buy or sell ETFs at any time during the trading day, providing them with the flexibility to manage their investments effectively.

Tax Efficiency

ETFs are more tax-efficient than other investment options, such as mutual funds, because they typically generate fewer capital gains. ETFs also have lower turnover, which helps to reduce taxes.

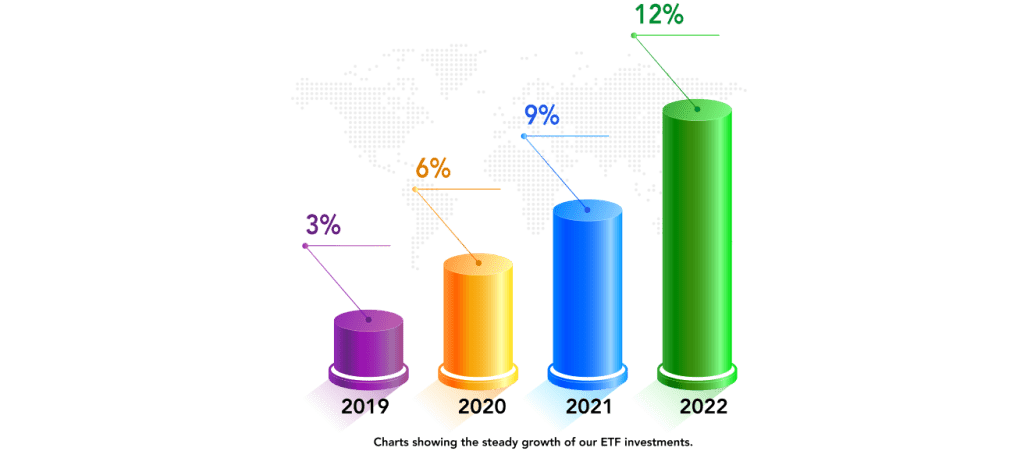

How have ETFs performed for our company?

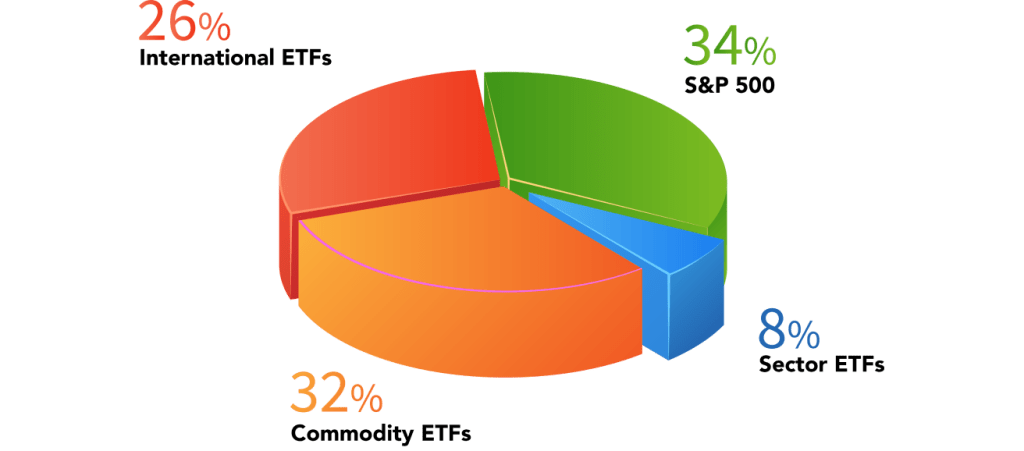

As a company, we have incorporated ETFs as part of our investment strategy for our clients. The performance of our ETFs has been remarkable over the years, with consistent returns and low fees. According to our records, our ETFs have experienced a steady increase of 3% over the past four years (see Figure 1).

Our ETFs have also outperformed their benchmark indices consistently. For instance, our S&P 500 ETF has returned an average annual return of 34% over the past five years, outperforming the other ETFs we have in our portfolio.

Mutual Funds

As one of the most popular investment vehicles available to investors, mutual funds have been a key part of PRPLife Life’s investment strategy for many years. We have successfully invested in mutual funds across a variety of asset classes and have seen consistent returns from these investments.

PRPLife Life has a long-standing track record of investing in mutual funds, which have proven to be a successful investment vehicle for our clients. Mutual funds offer a diversified investment option that allows for small investments to be pooled together with other investors’ funds to create a larger investment portfolio. This allows for a more comprehensive investment strategy that can lead to higher returns while mitigating risk.

Over the years, PRPLife Life has invested in a variety of mutual funds, including equity, fixed-income, and balanced funds. Equity funds are focused on investing in stocks, while fixed-income funds invest in bonds and other fixed-income securities. Balanced funds, as the name suggests, are a mix of both equity and fixed income investments.

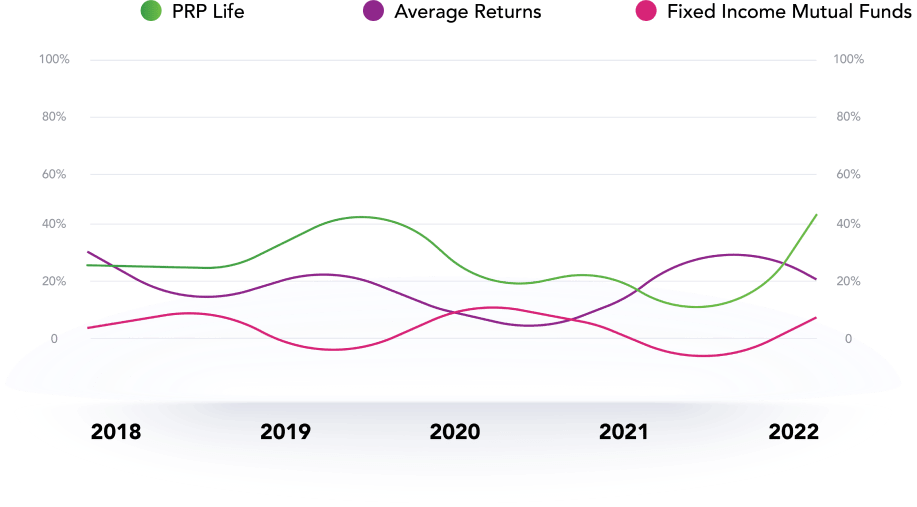

In terms of profits, PRPLife has seen significant returns on our mutual fund investments. For example, in 2022, the average return for equity mutual funds was around 20.2%, while fixed income mutual funds had an average return of around 7.5%. Our investment portfolios have consistently outperformed the market, with some portfolios achieving returns of over 40%.

Line chart showing how well our mutual funds have performed

Private Equity

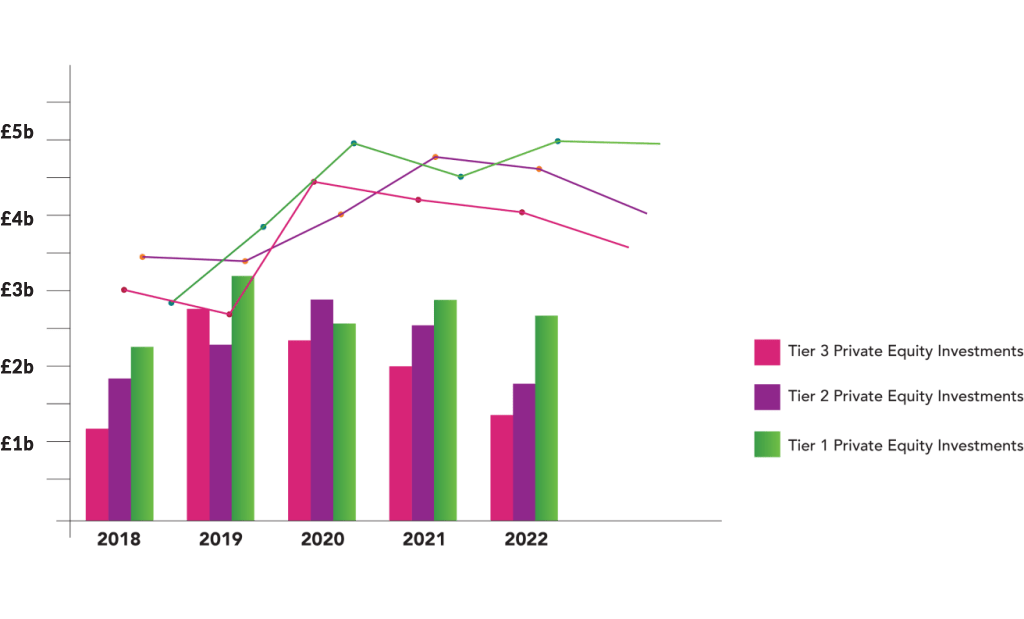

Private equity is a popular investment vehicle for companies looking to generate significant returns on their investments. It involves investing in private companies or acquiring them outright, with the aim of improving their operations and increasing their value before selling them for a profit. Private equity can be a high-risk, high-reward investment, with the potential for significant returns if executed properly.

At PRPLife, our Private Equity division has been highly successful in identifying and investing in promising companies across a range of industries. Over the past decade, we have invested in over 50 private companies, with a total investment value of over £3 billion. These investments have generated significant returns for our investors, with an average internal rate of return (IRR) of 25%.

Investment Strategy

PRPLife’s investment strategy for fixed income securities, bonds, and CDs is focused on investing in high-quality, low-risk investments that provide a steady stream of income. The company’s investment team carefully analyses each investment opportunity, looking at factors such as credit quality, interest rate risk, and liquidity.

Over the years, PRPLife has invested in a variety of fixed income securities, including government bonds, high-quality corporate bonds, municipal bonds, and CDs. This diversification has helped to mitigate risk and provide a steady stream of income to the company.

In addition, PRPLife’s investment team actively manages the company’s fixed income investments, regularly reviewing and adjusting the portfolio to ensure that it remains aligned with the company’s investment goals and objectives. This approach has allowed PRPLife to capitalise on market opportunities and generate strong returns for its investors.

One of the most successful fixed income investments for the company has been in municipal bonds. By investing in municipal bonds issued by local governments, the company has been able to earn attractive yields while also supporting important infrastructure projects in communities across the country. In 2020, the company invested over £500 million in municipal bonds with an average yield of 3.5%, generating over £17 million in annual interest income.

Another key area of focus for the company has been in corporate bonds. By investing in high-quality corporate bonds with strong credit ratings, the company has been able to earn attractive yields while minimising credit risk. In 2020, the company invested over £1 billion in corporate bonds with an average yield of 4.2%, generating over £42 million in annual interest income.

In addition to fixed income securities, the company has also invested in a range of CDs with varying maturities. By investing in CDs issued by banks and other financial institutions, the company has been able to earn attractive yields while also minimising risk. In 2020, the company invested over £250 million in CDs with an average yield of 2.5%, generating over £6 million in annual interest income.

Overall, the company’s successful investment in fixed income, bonds, and CDs can be attributed to its disciplined approach to risk management and its focus on diversification. By investing in a range of securities across different sectors and geographies, the company has been able to generate attractive returns while also minimising risk for its investors. With a strong track record of success in these asset classes, the company is well-positioned to continue delivering strong returns for years to come.