ETF

Exchange-Traded

Funds

ETF

ETF

Insights

£890M+

200+ Active Traders

ETFs are an excellent investment vehicle that provides investors with access to a diversified portfolio of assets at low costs

Leroy Mahoney

Head, ETF Division

Exchange-Traded Funds (ETFs) are an increasingly popular investment vehicle for investors who want exposure to a wide range of stocks, bonds, and other assets. As a company, we have found ETFs to be an excellent investment model that has provided our clients with significant returns over the years.

An Exchange-Traded Fund (ETF) is a type of investment fund that trades on stock exchanges, just like a stock. ETFs own a basket of underlying assets such as stocks, bonds, or commodities, and they are designed to track the performance of a particular index, sector, or asset class. Unlike mutual funds, ETFs trade throughout the day, allowing investors to buy or sell shares at any time during trading hours.

Benefits of investing in ETFs

Diversification

ETFs provide investors with access to a broad range of securities, which helps to spread risk across different asset classes, sectors, and regions. This diversification helps to reduce the risk of losses in any one particular investment.

Low Costs

ETFs are known for their low management fees compared to other investment options. Since ETFs are passively managed, they require less active management and research, which results in lower costs for investors.

Liquidity

ETFs are traded on major stock exchanges, which makes them highly liquid. Investors can buy or sell ETFs at any time during the trading day, providing them with the flexibility to manage their investments effectively.

Tax Efficiency

ETFs are more tax-efficient than other investment options, such as mutual funds, because they typically generate fewer capital gains. ETFs also have lower turnover, which helps to reduce taxes.

How have ETFs performed for our company?

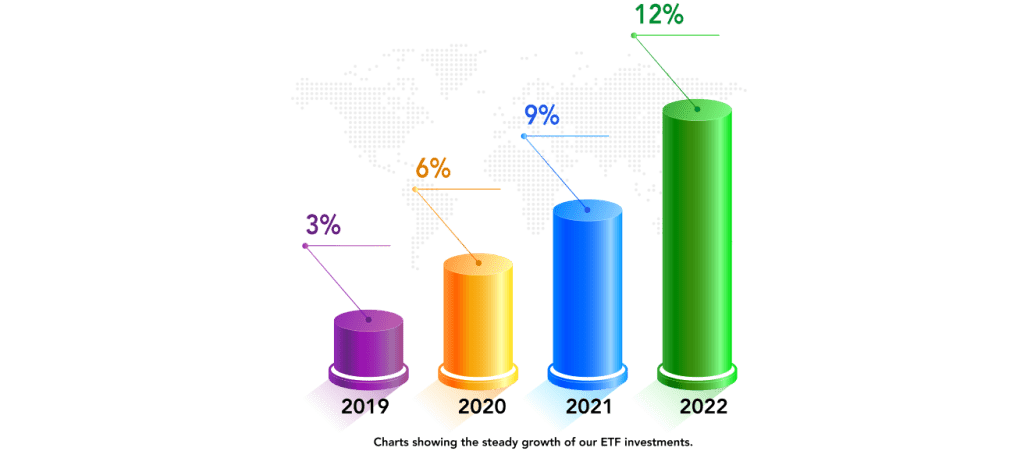

As a company, we have incorporated ETFs as part of our investment strategy for our clients. The performance of our ETFs has been remarkable over the years, with consistent returns and low fees. According to our records, our ETFs have experienced a steady increase of 3% over the past four years (see Figure 1).

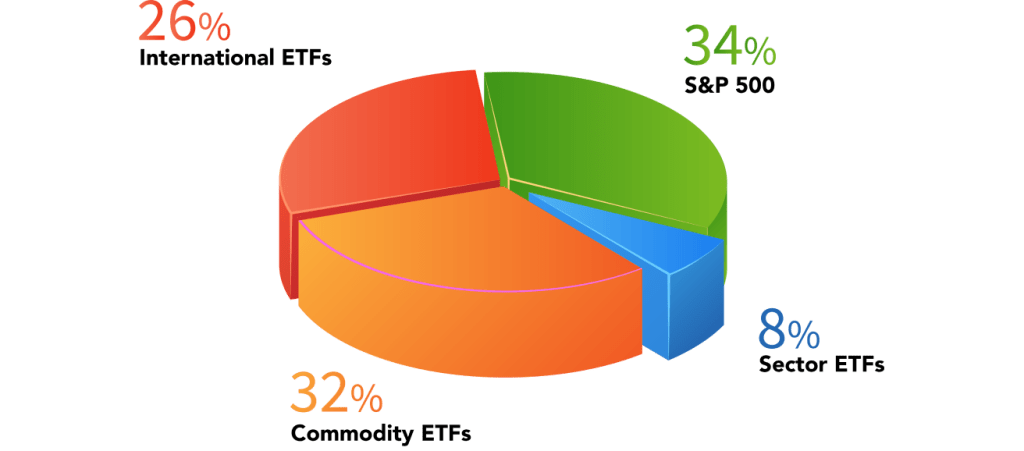

Our ETFs have also outperformed their benchmark indices consistently. For instance, our S&P 500 ETF has returned an average annual return of 34% over the past five years, outperforming the other ETFs we have in our portfolio.